CMOS: advanced and beyond

Discover why imec is the premier R&D center for advanced logic & memory devices.

Integrated photonics

Take a look at technologies for optical transceivers, sensors and more.

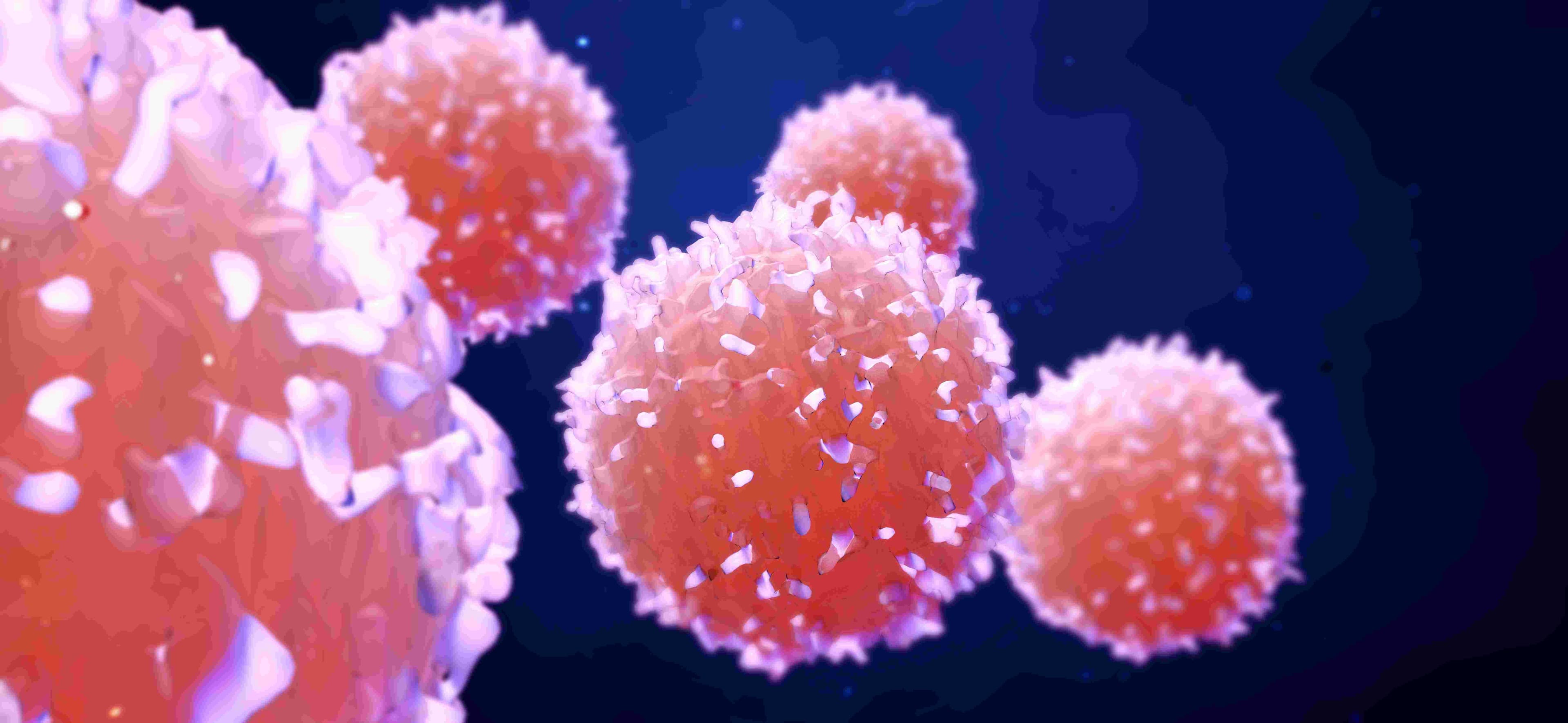

Health technologies

See how imec brings the power of chip technology to the world of healthcare.

Sensing and actuation

Explore imec’s CMOS- and photonics-based sensing and actuation systems.

Connectivity technology

Look into our reliable, high-performance, low-power network technologies.

More expertises

Discover all our expertises.

Research

Be the first to reap the benefits of imec’s research by joining one of our programs or starting an exclusive bilateral collaboration.

Foundry services

Build on our expertise for the design, prototyping and low-volume manufacturing of your innovative nanotech components and products.

Venturing and startups

Kick-start your business. Launch or expand your tech company by drawing on the funds and knowhow of imec’s ecosystem of tailored venturing support.

Education and workforce development

Imec supports formal and on-the-job training for a range of careers in semiconductors.

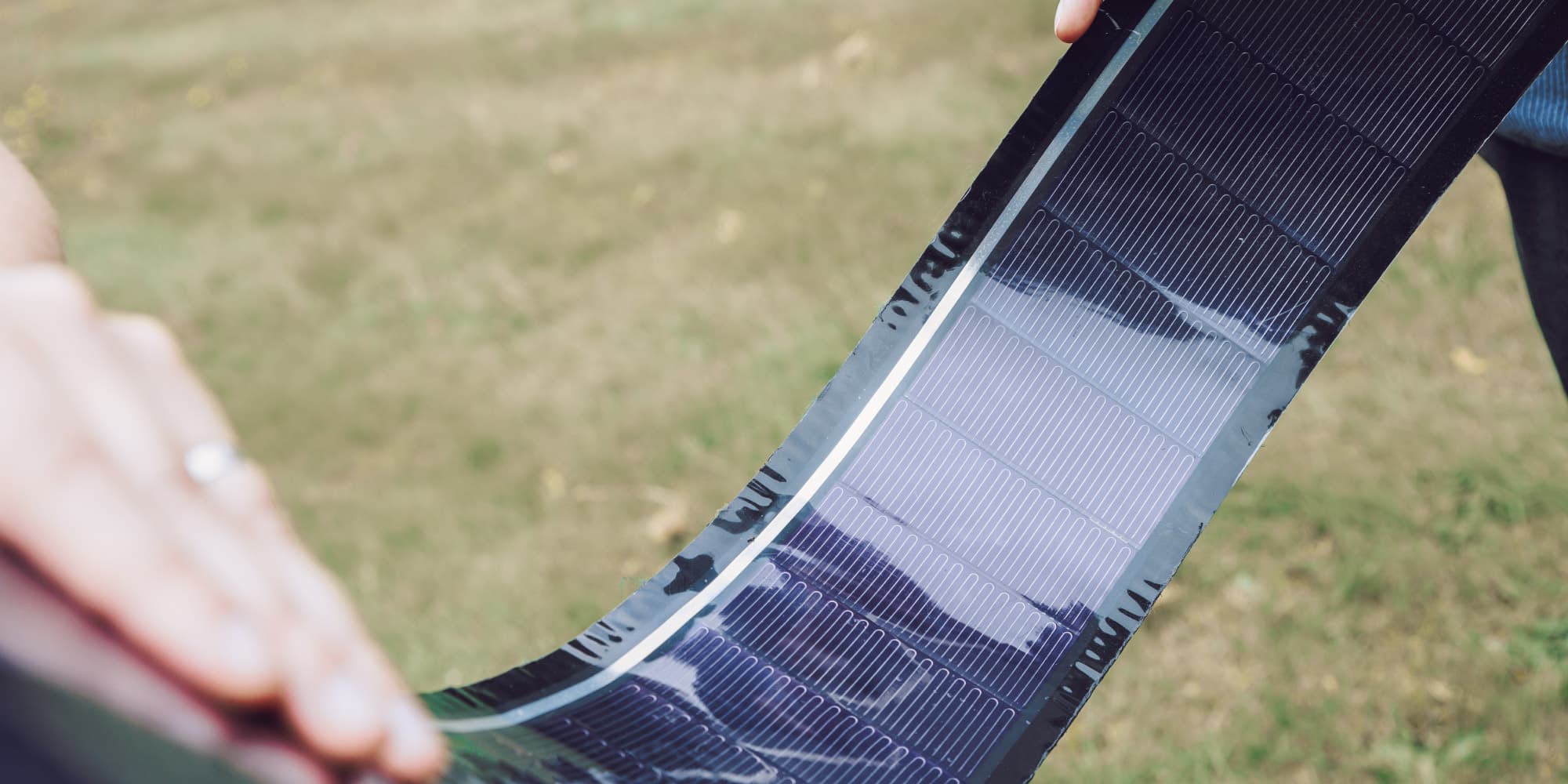

NanoIC pilot line

Aligned with the EU Chips Act, access to the pilot line will accelerate beyond-2nm innovation.

Press release